Equinor and Var Energi have recently started production of Johan Castberg, which is a 34.7oAPI crude with 0.16wt% sulphur. Compared with Johan Sverdrup, it is a much lighter and sweeter crude. It is also more paraffinic, which is a good feature for FCC refineries. Based on API gravity and Sulphur, one might think that Johan Castberg has lower value than the other crudes in the Brent complex. However, based on the refining margin scenario that has so far prevailed in 2025, the refining value of Johan Castberg delivered to Rotterdam would have been between $3.50/bbl and $5.50/bbl higher than Forties, which sets the price of Brent very frequently. This is mostly attributable to higher yield of middle distillate.

Equinor and Var Energi will soon start production of Johan Castberg, a field located in the Barents Sea. The field has estimated recoverable reserves of 450-650 million barrels. At peak, it may produce 220,000 barrels per day1. Johan Castberg will add to the recent development of Johan Sverdrup and will contribute to sustain Norwegian crude oil production into the future.

Quality Comparison

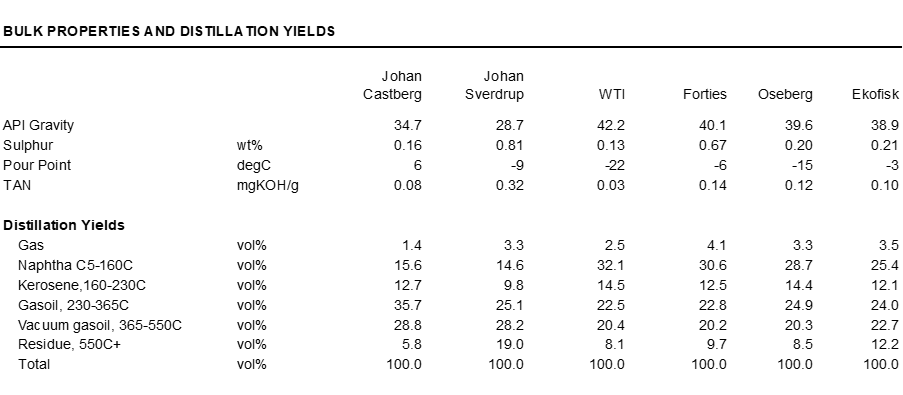

This paper is based on a crude assay published by Equinor according to which Johan Castberg is a 34.7AoPI crude with 0.16wt% sulphur2. A comparison with Johan Sverdrup3 shows that both crudes have a very high yield of vacuum gasoil, which is considered an attractive feature for European refineries. Both crudes have a high ratio of middle distillates to naphtha, which is also a positive feature for the European market because middle distillates are the highest value type of products.

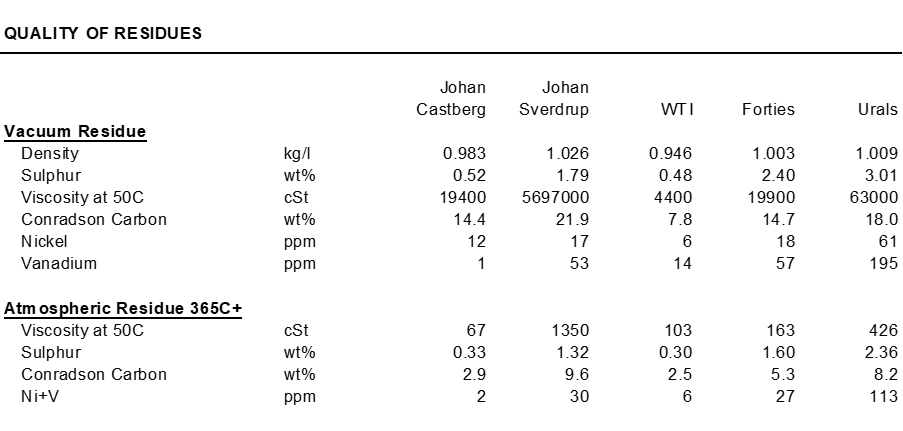

In many other fundamental respects, these are very different crudes. Johan Sverdrup has a high yield of vacuum residue, which can be used to fill up residue conversion units. This makes it a lower sulphur substitute of Russian Urals. By contrast Johan Castberg has a content of vacuum residue that is lower than WTI, which is the lightest crude of the Brent complex.

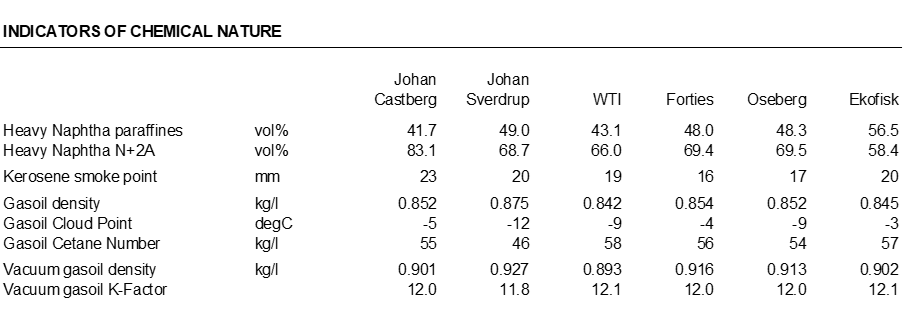

Johan Castberg is a paraffinic crude, whereas Johan Sverdrup has an intermediate chemical nature and some naphthenic acidity (TAN = 0.32). The difference in chemical nature is evident in the higher kerosene smoke point of Johan Castberg, the higher cetane number, the higher K-factor and the lower densities of the gasoil fractions. These are all indicators that these fractions have a higher content of hydrogen. Despite having paraffinic middle distillates, Johan Castberg has a more naphthenic heavy naphtha, which is good for naphtha reforming and for production of paraxylene, but bad for integration with steam crackers.

A question that is often asked about new North Sea crudes is whether they may fit in the Brent complex, so how does Johan Castberg compares with WTI and Forties, which set the Brent price most of the time?

Based on the API gravity, Johan Castberg is heavier than both WTI and Forties, and has a slightly higher content of sulphur than WTI. On this basis, one might think that Johan Castberg is a lower value crude than WTI and perhaps even lower value than Forties. However, the lower API gravity of Johan Castberg is in large part attributable to the much lower yield of naphtha, which has lower value than middle distillate.

The vacuum residue produced by Johan Castberg and WTI has very low content of sulphur, so both crudes are suitable for production of VLSFO at cracking refineries. Only a small percent of the global crude slate afford refineries this option.

Both Johan Castberg and WTI produce atmospheric residues with low content of contaminant, e.g. Conradson Carbon and metals. This means that the atmospheric residue can be cracked in FCCs without needing to be hydrotreated. On balance, Johan Castberg will be a very good substitute of WTI and the other crudes in the Brent complex and will be quite likely processed by the same kind of refineries.

Crude oil valuation

Crude oils derive their value from the value of the refined products that are made from them. Therefore, the relative value of any two crudes can be calculated from the refinery yields and product prices.

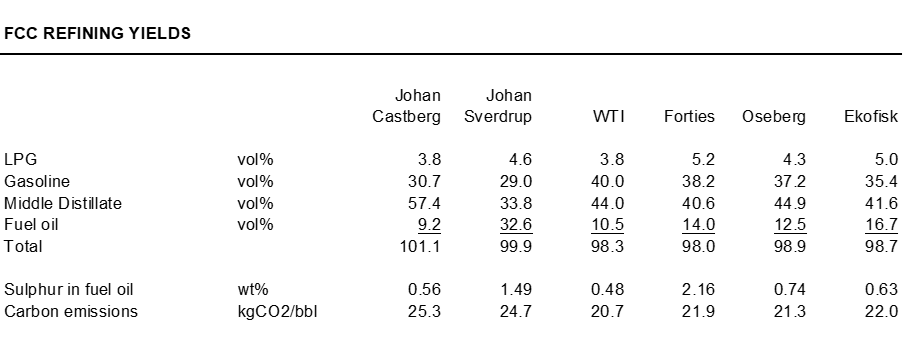

The table below compares the refining yields of Johan Castberg with the other crudes. The yields are for a simple FCC refinery. Of particularly high importance is the comparison with Forties and WTI, which often set the Brent price. Johan Castberg has the highest yield of middle distillates, the lowest yield of fuel oil and the highest volumetric expansion, because of the high yield of VGO fed to the FCC. Johan Castberg, WTI and Ekofisk all produce fuel oils that can be part of a VLSFO pool, so their valuation could benefit from high VLSFO-HSFO differentials.

Finally, Johan Castberg has a higher carbon intensity because it uses more cracking capacity. However, it has also a higher yield of light products. Thus, processing Johan Castberg emits 28.7kgCO2 per barrel of light transportation fuels produced, versus an average of 26.7kgCO2/bbl for the other four crudes that are part of the Brent complex.

A calculation of the refining value of these crudes at 2025 product prices shows that Johan Castberg was worth ~$3.0/bbl more than WTI and ~$5.0/bbl more than Forties. However, this comparison is unfair because Johan Castberg uses an amount of FCC capacity that is 28 vol% of crude distillation capacity vs 20 vol% for both WTI and Forties. For a refinery that plans its operations against the maximum FCC capacity, this carries an opportunity cost that must be considered. When corrected for this factor, the valuation of Johan Castberg falls to “Forties + $4.0/bbl”.

The period between March 2022 and July 2024 has been unusual for having very high hydroskimming margins. Historically, this was not the case. With strongly positive hydroskimming margins, refineries are expected to operate distillation capacity beyond the technical capacity that is balanced with conversion capacity. Therefore, when evaluating the economics of substituting one crude versus another, their LP models will value the crudes based on hydroskimming yields. On this basis, Johan Castberg would have been worth “Forties + $4.50/bbl”.

A final consideration is whether a low sulphur crude like Johan Castberg would be processed as part of a sweet slate, where vacuum residue is used to make VLSFO, or whether this feature of the crude is lost in a composite slate. The price differential between VLSFO and HSFO has reduced considerably in 2025, but is still at around $60/tonne. Assuming that residue is segregated and used to make VLSFO is has been worth approximately $0.80/bbl at 2025 average prices.

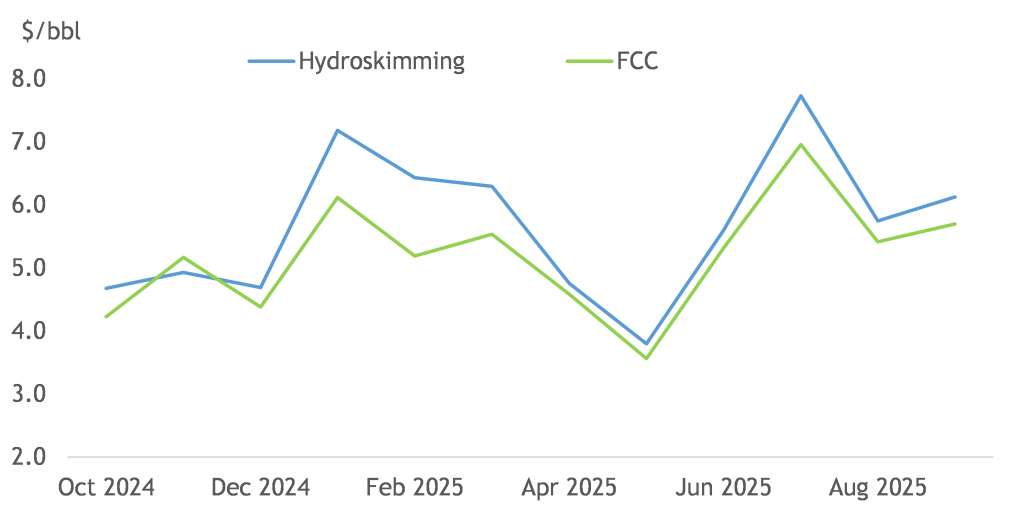

The figure below shows a predicted price of Johan Castberg CIF Rotterdam for the last 12 months plotted as differential to Brent. The inclusion of Johan Castberg in the Brent basket would require a very substantial quality adjustment.

Figure 1: Johan Castberg valuation, CIF Rotterdam – Dated Brent

As a final comment, the estimate of the refining values capture carbon costs at prevailing prices. The higher emissions of Johan Castberg reduce its value relative to Forties by $0.26/bbl in the FCC refinery.

© Midhurst Downstream, 2025

1 https://www.equinor.com/news/johan-castberg-anchored-on-the-field (accessed on 7 March 2025)

2 Crude assay published on the Equinor website and dated October 2024

3 Crude assay published on the Equinor website and dated April 2021